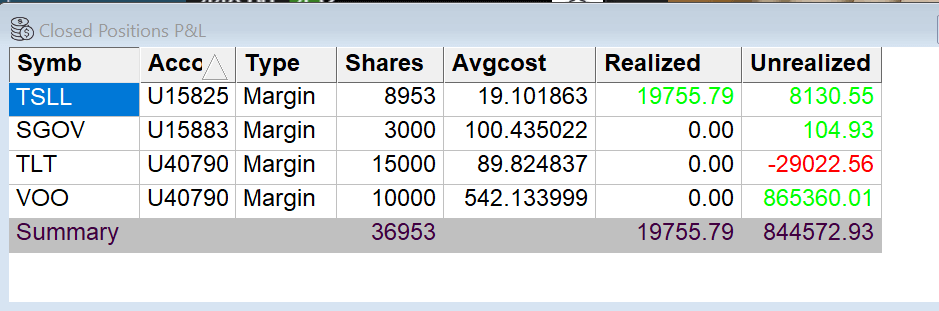

$19K Profits on $TSLL Tesla Opening Range Breakout!

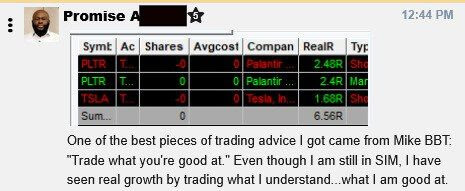

| Trade what you’re good at. You only need to be an expert in ONE strategy. |

|

Dear Traders, I did my trading today in Dubai, the global hub for entrepreneurs and traders. This city has an amazing energy that motivates me to pursue my goals. As usual, I filmed a recap of my trades today as part of my personal journaling and reflecting. Even though I didn’t have a crazy 6 or 7-figure day, I’m proud to share that I did 3 crucial things correctly, as a day trader:

In my opinion, my trading performance today is a great educational material for traders who care to study my thought process and how I manage a trade. I filmed a YouTube recap to go over the little details and small decisions that matter to my performance today.

|

|

|

| As you can see on my trade execution chart, instead of trading $TSLA, I chose $TSLL, which is a 2x daily ETF that tracks $TSLA. I have mentioned many times during our morning livestream that $TSLL is a great instrument for day traders because you can trade more shares with less capital. In day trading, this is more efficient and beneficial for position sizing (scaling in and out of a trade).

Most stocks were selling off or chopping up and down during the opening hour today. But Tesla was a beauty in its own world. I was watching it this morning because it was oversold yesterday due to an analyst downgrade news. I entered my first trade using the 1-Min Opening Range Breakout setup, and it ended up a losing trade that I cut according to my trade book (stop loss below VWAP and Opening Range). Right after I executed my stop loss, I saw a textbook setup that I’m very familiar with:

So I did not hesitate to take my second trade on $TSLL, and I used $TSLA Market Atlas level 2 map to help me take partials and added more to stay in the nice uptrend breakout. You can study the full trade recap that I uploaded to YouTube and see how I use the candlestick chart and Market Atlas level 2 map side-by-side.

|

|

| BBT member shared his progress in trading after finding a niche to focus on: “Trade what you’re good at”.

|

|

To day trade for a living, you really don’t need to be greedy. Just be good at 1-2 setups and keep refining your trade book until you become an expert of your niche. If you watch me trade live every day, you know that I rinse and repeat the ORB and ABCD trade books. If you haven’t joined us, you can start with the 3 FREE strategy crash courses that we’ve prepared for you. These 3 crash courses include:

Learn a trade book for free, and come trade live with us. |

|

Also, don’t forget to take advantage of our $50K Funded Training Account at TradingTerminal.com. If you’re not ready to start the funded account, you can trade on the real-time simulator first to get used to the real-world trading environment. Take care, |