5,000% increase in 1 week – Not safe

Dear Traders,

What a week in the markets!

Today’s chatroom session was fun, energetic, and educational, even though it was a red day for me. I talked about $DRUG, and doing Uber with my Lambo. Megan talked about performance anxiety and burning out.

DRUG, the main headliner last few days, skyrocketed almost 5,000% in a single week! Imagine turning a $1,000 investment into $50,000—sounds like a dream, right? Well, I wish it were that simple. Reality is completely different in trading, especially when trading low-float stocks. Every time you hear one of these massive numbers and start to feel FOMO, just remember that thousands of people lost their lifetime savings because they thought it was easy and they were smarter than everyone else in the market! Let me explain what makes these trades so tricky.

When I first started trading, I used to trade low-float stocks and managed to make some huge profits, but those gains came with even bigger losses. I found it difficult to maintain consistency, and after seeing my account take serious hits, I decided to stay away from low floats altogether. That consistency, which is so crucial for long-term success, only came when I shifted my focus to mid- and large-float stocks like AAPL, TSLA, NVDA, and AMD.

Small float stocks, those with fewer shares available to trade, are prone to huge wild price swings. While these can offer substantial gains, they also come with increased risk. On the other hand, large float stocks tend to provide more stable price action, helping traders protect their capital.

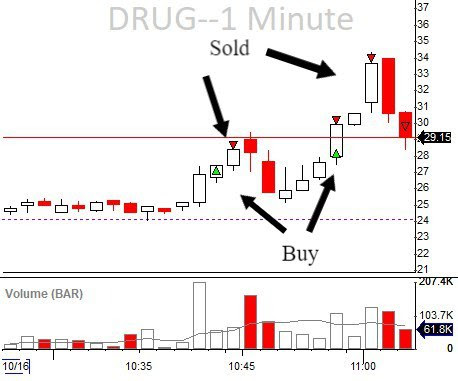

An interesting case this week was Bright Minds Biosciences $DRUG, a low-float stock that surged over 1,400% in one day. This example highlights the unpredictability of small float stocks and emphasizes the importance of strict risk management tools.

Several BBT traders managed to capture profits from the massive swings in $DRUG. However, these success stories show that trading fast-moving, low-share stocks is not for everyone, as it requires experience, structured rules, discipline, and risk management tools.

If you are not part of our community yet, you can get one week of access to our chatroom, real-time trades, and insights from top traders just for $1. I have been in your shoes and know how the right mentor and community can make a difference.

Join for $1 – Limited Time!

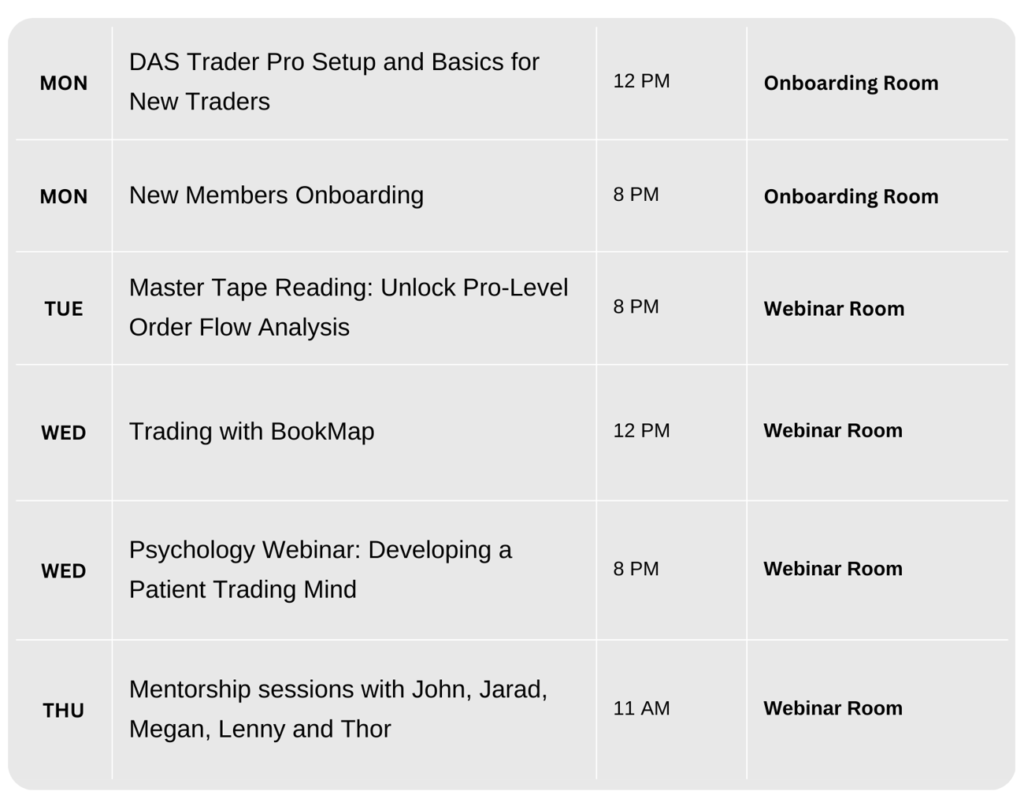

Next week is full of learning opportunities with our live webinars and mentorship sessions. On Monday, we kick off with Brendon at 12 PM ET for a DAS Trader Pro setup live session, ideal for new traders or those looking to optimize their platform. In the evening, Carlos will lead the New Members Onboarding at 8 PM, introducing you to our community and helping you start your trading journey on the right foot.

On Tuesday at 8 PM, Paras will teach Master Tape Reading, showing you how to read order flow and improve your trade execution.

On Wednesday at 12 PM, Nathan returns with his Trading With BookMap live webinar, giving you insights into market depth and order flow. Later that evening, Rande Howell will host the Psychology Webinar at 8 PM, focusing on how to develop a patient and disciplined trading mindset.

Thursday is packed with live mentorship sessions with John at 11 AM, Jarad & Megan, Lenny, and Thor.

You can see all the webinars below. Make sure to check as many webinars as you can each week to improve your trading. All webinars are free for Elite and Diamond members.

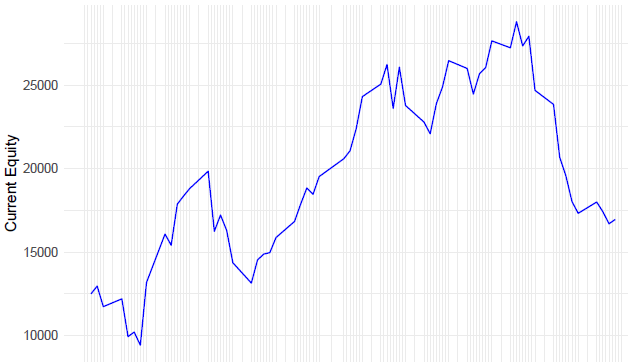

Trading is a rewarding, but challenging skill. Even with a strong start and a smooth equity curve, it only takes one or two emotional missteps to wipe out hard-earned profits. We’ve seen it happen—greed kicks in, and discipline slips, leading to devastating losses. It’s a critical reminder that success in trading isn’t just about strategy but also about managing emotions. Consistency is key, and knowing when to step back is as important as knowing when to trade. If you don’t know, you might over-trade and burnout.

Today in the chatroom Megan talked about how to avoid burning out and getting anxiety. She blew up her account after 1 year she started trading but with practice and discipline she could recover those losses.

Check out the screenshot below to see how emotional trading can impact an equity curve. This is the equity curve from one of our Funded Training Accounts.

The trader was doing so well but he probably got emotionally burned and lost his discipline. As Megan said, it is so important to set rules for yourself not to burn yourself out.

If you are still new to trading and not a consistently profitable trader, I highly recommend trading in our Funded Training Account. You can practice your skills, emotions, and discipline without losing your money to the market. All the profitable traders get their profits out.

Join Diamond Annual for 50% Off

The Funded Training Account is a great way to practice trading like a real brokerage account, without the financial risk.

To your success,

Andrew