Stock Market After Election

Dear Traders,

What an incredible day in the markets. The SPY hit all-time highs this morning, and if you were trading, you know how exciting it was. These are the kinds of days that remind us why we love trading—big moves, lots of opportunities, and plenty of action.

Let’s take a look at what went down today and talk about how yesterday’s election results might play into the market’s next moves.

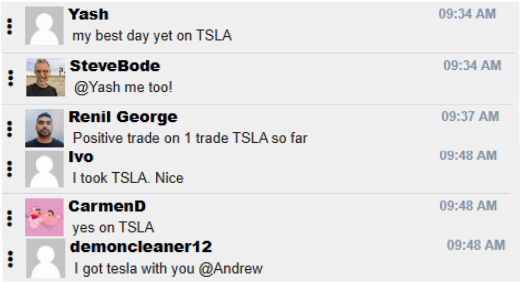

TSLA was the star of the show today, gapping up over 15% pre-market. The volatility was exactly what we hoped for, and the chatroom was packed with traders catching some great moves.

Whether you were scalping those quick breakouts or holding for a longer trend, TSLA didn’t disappoint. It’s always exciting to see our community come together, share ideas, and make the most of these big opportunities.

If you haven’t joined us in the chatroom yet, now’s the time! For just $1, you can get a 7-day trial and see how we trade together every day.

You’ll get access to our live trading sessions, daily watchlists, and a supportive group of traders.

Join for $1 – Limited Time!

One of the companies that helped push the market to all-time highs is definitely NVIDIA (NVDA), which just hit a market cap of $3.43 trillion, surpassing Apple (AAPL) to become the world’s most valuable company.

Over the past year, NVDA has been a major force behind the market’s climb, thanks to its leadership in AI and high-performance computing. Its growth has been nothing short of phenomenal, and today’s milestone cements its role as a market mover.

For traders, NVDA’s rise is a reminder to stay focused on sectors driving innovation and growth.

Big news from yesterday’s election—Donald Trump is back, and the Republicans have regained control of the Senate. This marks a significant shift in the political landscape, with potential implications for the markets.

Historically, Republican administrations have been associated with business-friendly policies, including tax cuts and deregulation. These measures could lead to bullish momentum, particularly in sectors like energy, finance, and healthcare. For example, energy companies may benefit from relaxed environmental regulations, while financial institutions could see lighter oversight.

However, there’s more to consider. Trump’s previous term saw significant market volatility, driven by his trade policies, including tariffs and disputes with major economies like China. His return could reignite similar uncertainties, especially if new trade restrictions or tariffs are announced. Additionally, his influence on Federal Reserve policies could create waves in monetary policy, potentially impacting inflation and interest rates.

As traders, it’s crucial to stay alert. While markets may initially react positively to the promise of pro-business policies, the long-term impact will depend on how these policies unfold. Keep an eye on key sectors and be prepared for shifts in market sentiment as new announcements come through. Flexibility and a solid strategy will be key in navigating these changing dynamics.

To your success,

Andrew