How Long Does It Take to Become a Profitable Trader?

Dear Traders,

What a morning! We had an amazing trading day on Tesla and PLTR in the chatroom. For those of you who were trading live with us, you saw it happen in real-time—Tesla gave us a 6–7% move, which translated into nearly a 12% move on TSLL. Huge win for a lot of traders in the room today.

The market opened super strong, mostly because of some positive developments over the weekend. There was a lot of fear building up about trade wars and the April 2nd “liberation date” that President Trump mentioned. But it turns out the scope of the tariffs is much smaller than expected, and the fears were overblown. Once that news came out, the market rallied hard.

We saw some massive moves across the board, especially in high-flying names like Tesla, AMD, PLTR—and even small caps like IWM were catching bids.

Something we also discussed in the room today was how sentiment often follows price, not the other way around. Everyone thinks bad news and negative sentiment cause the markets to crash—but usually, prices drop first, and then people start freaking out and making up narratives like, “Oh, a recession is coming,” or “The global economy is collapsing.”

I remember back in March 2009 during the financial crisis, Time magazine put out a doomsday cover basically saying civilization was ending and we should all stock up on canned food. Funny thing is… that cover came out right at the bottom of the market—March 9, 2009, to be exact. The market ripped from there. That’s how it works: extreme fear = market bottom.

Even personally, I have no real financial problems right now. But when the market dropped 10–12% in just two weeks recently, I caught myself worrying about my spending and lifestyle. It’s wild how closely our mood and decisions are tied to what the market is doing.

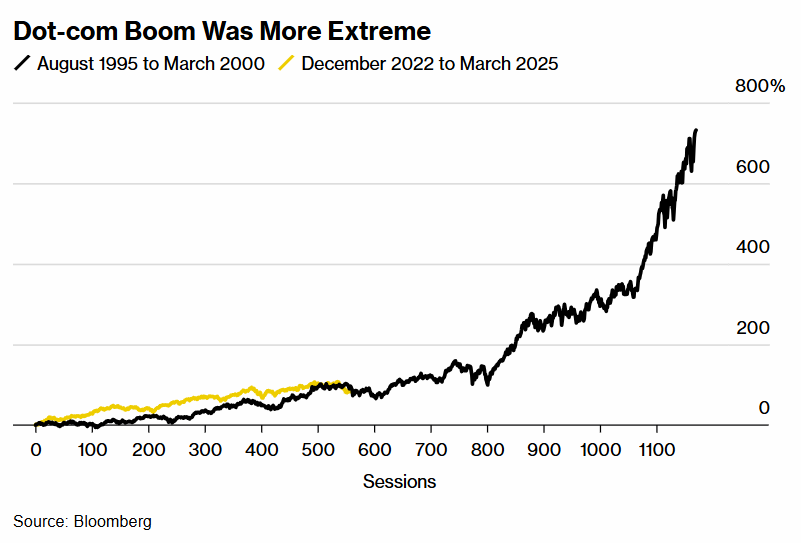

Now, on a bigger picture note—there’s a lot of talk going around about whether we’re in a bubble, similar to the dot-com era. AI has a lot of similarities to the internet boom in the ’90s. When the internet started picking up in 1995, everyone knew it would change the world. Netscape IPO’d in August 1995, and from then until the top in March 2000, the Nasdaq went up 718%. Then it collapsed—by October 2002, more than 80% of the Nasdaq’s value was gone.

So today I was looking at a chart from Bloomberg that compares the AI rally starting from November 2022 (around the ChatGPT launch) to the dot-com rally that began in 1995. I’ll include the chart in the email for you to check out. It’s really interesting—turns out, we’re not in the same kind of bubble territory yet.

The biggest difference is that the companies leading the AI wave today—Nvidia, Microsoft, Meta, etc.—have strong financials. They’re cash flow positive and profitable. These aren’t like the cash-burning startups of 2001. Sure, valuations are high, and price-to-earnings ratios are above average, but it’s not the same kind of blind speculation we saw back then

And now for the big news…

This week is probably the most exciting one of the year for our community! The whole team is flying into Vancouver, and we’re kicking off an incredible 3-day summit starting this Saturday with TEDx.

All our VIPs are arriving Thursday—we’ll be hosting them at my place. Then on Friday, we’ve got VIP dinners, breakfast and lunch with the speakers, and more. I seriously can’t wait to see so many of you.

We still have a few spots left—so if you’re on the fence, come join us!

Sign up for Vancouver Live Trading Summit

Here’s the schedule:

- Saturday: TEDx event + Gala Dinner + After Party

- Sunday: Full day of conferences, workshops, and masterclasses

- Monday: Live trading + more presentations and community events

It’s going to be packed with value, energy, and a lot of fun. I hope to see as many of you there as possible.

Exclusive Offer for Attendees: Credit Towards Our May 2025 Bootcamp

I’m also thrilled to announce our 15th Bootcamp, starting in May 2025. This comprehensive three-month program is designed to elevate your trading skills and includes:

- A $50,000 funded training account.

- Daily live trading sessions with our experienced moderators—Avi, Thor, Megan, and others.

- Interactive sessions where you can ask questions in real-time, gaining deeper insights into the thought processes of seasoned traders.

To give you a glimpse of the impact this program can have, here’s some feedback from Katrina, one of our recent Bootcamp participants:

“Being someone that started from zero practice and very little theoretical knowledge, I feel I made huge progress. Getting into what it takes to be a trader, getting the chance to watch real traders ‘at work,’ getting much more knowledge than I was expecting, and making new friends—all together made an exceptional experience.”

Katrina also highlighted the invaluable mentorship she received:

“Special thanks to Carlos, my group mentor: he experienced me so lost, overwhelmed, and almost crying during our 3rd group meeting. Without him, I would have probably dropped the Bootcamp.”

If you’ve been thinking about leveling up your trading game, now’s the time. Our Peak Capital Trading Bootcamp is kicking off in May 2025, and it’s designed to help you build the skills and confidence you need to trade like a pro.

Check out Bootcamp details and sign up here!

We’ve packed this bootcamp with everything we’ve learned over the years—from strategy and risk management to psychology and real-time practice. If you want to see exactly what’s included, you can check out the full curriculum here.

If you have any questions at all, feel free to shoot me an email at andrew@bearbulltraders.com or reach out to Mike at mike@bearbulltraders.com. We’re happy to help you figure out if this is the right fit for you.

I’m really looking forward to seeing you—both in Vancouver and inside the bootcamp!

With the market rallying, major trading opportunities presenting themselves, and our Vancouver event just around the corner, this is an exciting time for traders. Whether you’re joining our Bootcamp, the Vancouver Summit, or just following along with our live trading streams, I encourage you to stay engaged, stay disciplined, and keep refining your edge.

See you in Vancouver,

Andrew