FOMC Rate Cut, $OPEN Short Squeeze, Amazing Trading Opportunities

Trade the price, not your bias.

Dear Traders,

I am still up here at 16,000 feet, getting ready for my final rotation before the summit push on Manaslu. In about ten days, I hope to make the climb to the top. I wanted to share a quick picture of my trading setup from the mountains with you, and also tell you about an amazing trade I had today.

Today was a really big day trading $OPEN.

$OPEN has been on my watchlist for the last couple of weeks, but things got really interesting when I saw a post on X from Martin Shkreli. For those of you who may not know him, he is a well known but controversial figure. Back in 2015, he bought Turing Pharmaceuticals and raised the price of one of their drugs from $10 to $750 per pill. That move made huge headlines, and eventually he got into trouble with regulators. He was convicted of securities fraud and served time in prison. He even appeared in front of Congress and openly mocked senators.

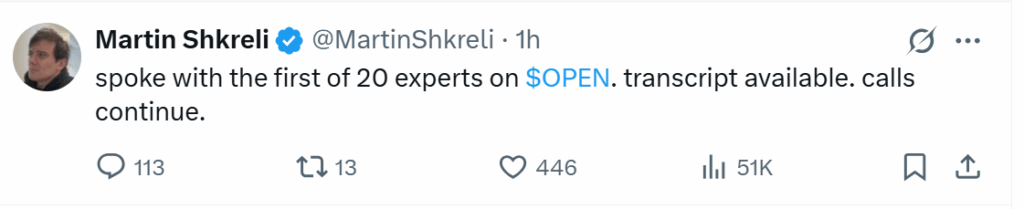

Now that he is out, I noticed he said on X that he shorted OPEN at $9.36. He mentioned this was his first trade back and that he was doing due diligence by calling former employees, customers, and competitors. When someone like him goes short, he usually does it in size. But to me, that made it even more interesting, because if the market starts to squeeze, he would be forced to cover.

Seeing this on X today on September 17, showing us that he is still short! (Perfect for a shot squeeze on him.)

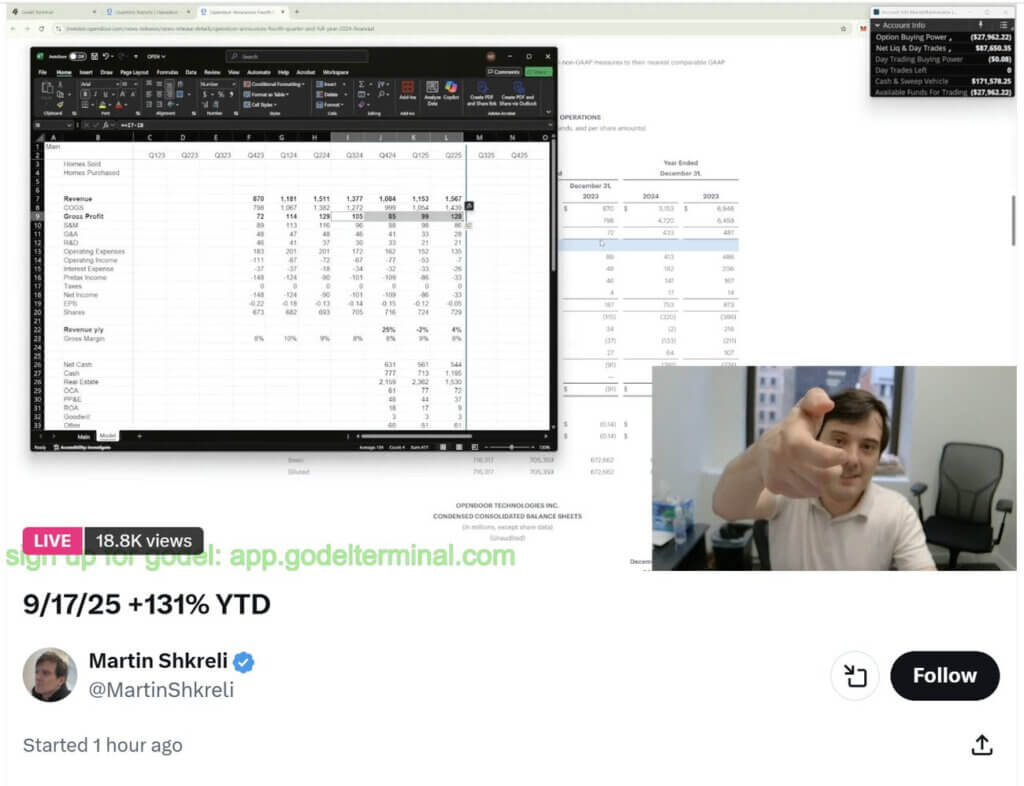

During his live stream, he was justifying how the fundamentals of the company could prove his trade idea right, and why he thought “$OPEN cannot go higher”.

But, do fundamentals really matter? Especially in a bull market, in this AI frenzy… Throughout today he kept posting that he believed OPEN was still a short. He was even updating his followers that he was talking to more people connected to the company.

But that was exactly why I thought it was a perfect setup for a squeeze. He has a large following, and many retail traders might just follow him blindly. That kind of trap can create a powerful opportunity.

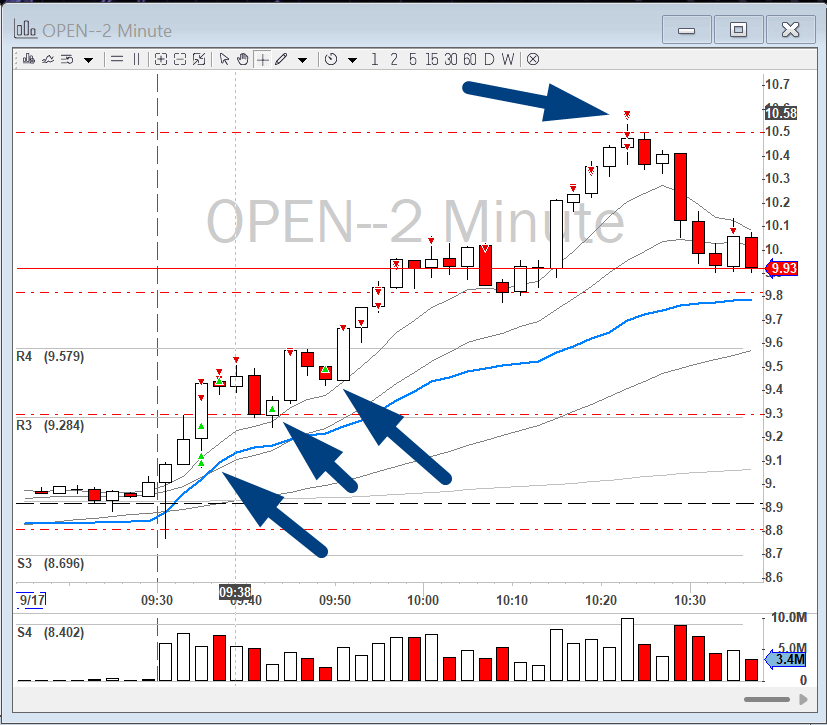

Let me explain why the price action is always right. Take a look at this Level 2 screenshot that I took in real-time.

Do you see the large order stacking at the ASK, signaling a high-volume break-out through $10?

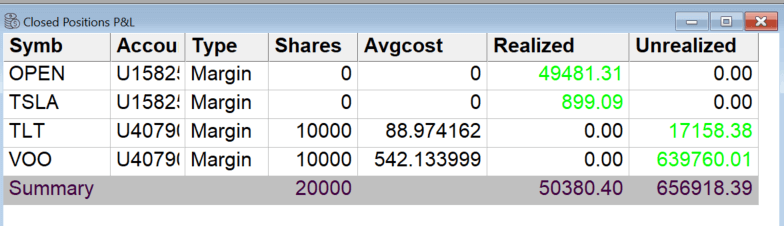

How did I trade this? At the market open, we saw a beautiful squeeze. I added several times on the pullbacks, watching the Level 2 closely. When I saw the ask stacking up above $10, I had more conviction. Eventually we got a very clean breakout and a really nice trade.

Here is the detailed video recap of the trade.

Now, here is what I want to remind you: The market is truly amazing, but you should NOT fall into the trap of social media influencers.

You never really know their intentions or what they are gaining from the trades they post. If you want to truly learn how to trade, join our community. That’s why in Bear Bull Traders community, we teach everything from the basics to risk management, from finding stocks to building your strategy. You also get access to scanners, technology, and real time trading examples.

Right now, our Elite annual membership is available at 50% off for only $1,199. That is less than $99 per month for full access to everything including education, strategy, psychology, and live trading.

I hope to see many of you inside our community.