Buffett’s Annual Letter / Key Highlights

I am back in a city I proudly call home: Vancouver, BC.

With spring just around the corner, it is gorgeous here. Thank you to everyone who came to visit Jarad, Norm and myself in Dallas, TX, and then myself in San Francisco, with both events being held on relatively short notice. I am humbled and blessed to have family members literally all around the world – from Nepal to San Francisco. Everywhere I go, I get to be with some of our members. I also stopped by to meet with Mike in California.

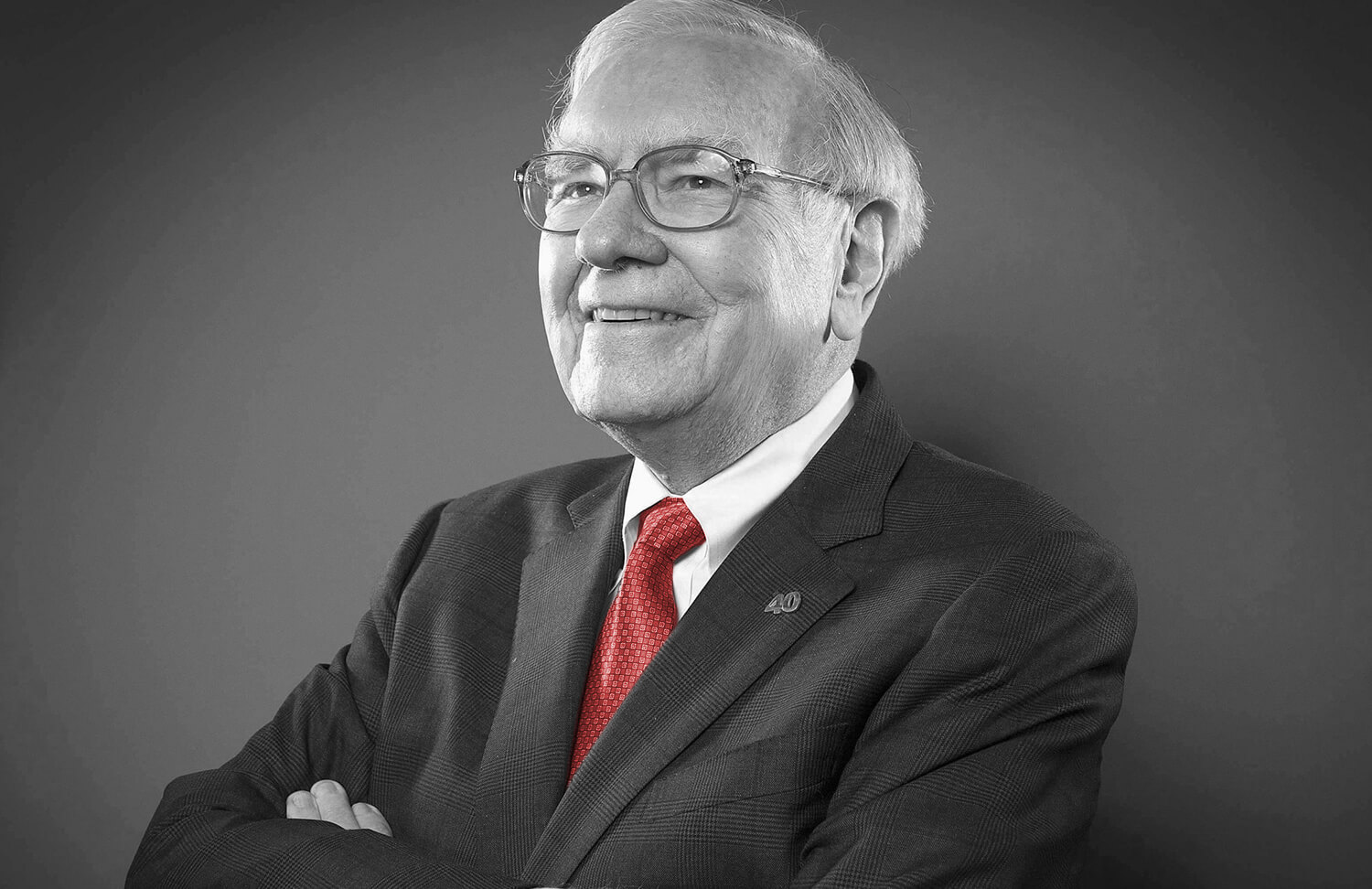

My apologies for missing the newsletter last week due to my travels. In this newsletter, I want to highlight Warren Buffett’s annual letter to Berkshire Hathaway shareholders, which the 90-year-old investing legend released on Saturday, February 27th. Here is a link: https://www.berkshirehathaway.com/letters/2020ltr.pdf . He has been issuing these letters since 1965 and they have become a must-read for investors and traders around the world. Warren Buffett is definitely an inspiration for many of us. In fact, both Ardi Aaziznia and I were inspired by him when writing together one of our newest publications: A Beginner’s Guide to Investing and Trading in the Modern Stock Market. His letters are always very personal, funny, and demonstrate his investing philosophy. If you would like to get to know Warren Buffett more, I strongly recommend that you take the time to go through this year’s letter yourself.

Value Investing is Dead!

It seems from this letter that he believes what we have been saying in the chatroom for the past little while: Value investing is dead! Well, perhaps not quite, but he made it very clear that it is becoming harder and harder to become a value investor in this market and to find great companies for a cheap price.

Integrity in Investing: Stick to What You Know

Warren Buffett is known to not invest heavily in the tech sector and he is considered a leader in fixed-asset ownership. As he wrote in his letter, this leadership in fixed-asset ownership “… does not, in itself, signal an investment triumph. The best results occur at companies that require minimal assets to conduct high-margin businesses – and offer goods or services that will expand their sales volume with only minor needs for additional capital.” To me, that sounds quite similar to many of the Silicon Valley technology companies that he has often hesitated to invest in. But why not?

He addressed this in his letter by discussing comments made in a book written way back in 1958 by a gentleman named Phil Fisher. In this book, Fisher:

Analogized running a public company to managing a restaurant. If you are seeking diners, he said, you can attract a clientele and prosper featuring either hamburgers served with a Coke or a French cuisine accompanied by exotic wines. But you must not … capriciously switch from one to the other: Your message to potential customers [the investors] must be consistent with what they will find upon entering your premises.

At Berkshire, he wrote, they “have been serving hamburgers and Coke for 56 years” and they are delighted with the clientele they have attracted. This is called integrity in my opinion, and that is why he is Warren Buffett and that is why both Ardi and I want to be like him.

He in an indirect manner recommended however that investors who do not like his taste of investing find other CEOs and gurus who match their taste to manage their money. One that comes to my mind is Cathie Wood, who is known for investing in technology and what she refers to as “disruptive innovation”. At Peak Capital Trading, Ardi and I have invested heavily in $ARKK, the Cathie Wood ETF that we both admire.

Own Stocks and Be Patient

Warren Buffett wrote in his letter that the “ownership of stocks is very much a “positive-sum” game. Indeed, a patient and level-headed monkey, who constructs a portfolio by throwing 50 darts at a board listing all of the S&P 500, will – over time – enjoy dividends and capital gains, just as long as it never gets tempted to make changes in its original “selections”. ”

He further wrote that: “Productive assets such as farms, real estate and, yes, business ownership produce wealth – lots of it. Most owners of such properties will be rewarded. All that’s required is the passage of time, an inner calm, ample diversification and a minimization of transactions and fees. Still, investors must never forget that their expenses are Wall Street’s income. And, unlike my monkey, Wall Streeters do not work for peanuts.”

Buffett’s newest 13F filing shows that he is holding almost $110 billion worth of Apple, and in this letter he even went as far as to call it one of his “family jewels”. He reported in his recent letter that when he finished his purchases of Apple in mid-2018, Berkshire “owned 5.2% of Apple at the cost of [only] $36 billion. Since then, He has both enjoyed regular dividends, averaging about $775 million annually, and have also – in 2020 – pocketed an additional $11 billion by selling a small portion of our position. Despite that sale – voila! – Berkshire now owns 5.4% of Apple. That increase was costless to him, coming about because Apple has continuously repurchased its shares, thereby substantially shrinking the number it now has outstanding.”

Sitting on Cash and Buying Back Shares

Buffett is sitting on $140 billion of cash and speculation is that he is waiting for a major sell-off or market correction in order to use his “art of the deal” and make an acquisition. He also bought back almost $25 billion worth of his own shares (which is a record in the past 10 years).

Admitting His Mistakes

He has a humble reflection and in his recent letter admitted to some of his mistakes in the past few years. Although he did not directly mention the selling of airlines right at the bottom of what we were in last spring, he did mention that some of his losses were due to his overexposure in the aviation and energy sectors. You may recall that Warren Buffett sold his airline positions due to the pandemic at a big loss, only to see the airlines bounce back a few months later.

Buffett wrote in this letter that his biggest loss in 2020 was what he called the “ugly $11 billion write-down” – which was “almost entirely the quantification of a mistake” he admitted to making in 2016. “That year, Berkshire purchased Precision Castparts (“PCC”)” and, as he wrote, “paid too much for the company”. As set out in his annual letter, this is how you go about accepting an $11 billion loss:

“The final component in our GAAP figure – that ugly $11 billion write-down – is almost entirely the quantification of a mistake I made in 2016. That year, Berkshire purchased Precision Castparts (“PCC”), and I paid too much for the company.

No one misled me in any way – I was simply too optimistic about PCC’s normalized profit potential. Last year, my miscalculation was laid bare by adverse developments throughout the aerospace industry, PCC’s most important source of customers.

In purchasing PCC, Berkshire bought a fine company – the best in its business. Mark Donegan, PCC’s CEO, is a passionate manager who consistently pours the same energy into the business that he did before we purchased it. We are lucky to have him running things.

I believe I was right in concluding that PCC would, over time, earn good returns on the net tangible assets deployed in its operations. I was wrong, however, in judging the average amount of future earnings and, consequently, wrong in my calculation of the proper price to pay for the business.

PCC is far from my first error of that sort. But it’s a big one.”

Do you see why he is a man of integrity? I cannot begin to imagine how difficult it would be to accept a loss like this.

Do Not Work Hard, Work Smart: No Need to Control the Company

Often, powerful investors take control of related companies in their entirety or at least with a majority ownership. Warren Buffett’s views have changed on having control over the businesses that he invests in, and he addressed this matter in his letter:

“Charlie [Charlie Munger, a 97-year-old genius] and I want our conglomerate to own all or part of a diverse group of businesses with good economic characteristics and good managers. Whether Berkshire controls these businesses, however, is unimportant to us.

It took me a while to wise up. But Charlie – and also my 20-year struggle with the textile operation I inherited at Berkshire – finally convinced me that owning a non-controlling portion of a wonderful business is more profitable, more enjoyable and far less work than struggling with 100% of a marginal enterprise.

For those reasons, our conglomerate will remain a collection of controlled and non-controlled businesses. Charlie and I will simply deploy your capital into whatever we believe makes the most sense, based on a company’s durable competitive strengths, the capabilities and character of its management, and price.

If that strategy requires little or no effort on our part, so much the better. In contrast to the scoring system utilized in diving competitions, you are awarded no points in business endeavors for “degree of difficulty.” Furthermore, as Ronald Reagan cautioned:

It’s said that hard work never killed anyone, but I say why take the chance?

Not the Bond Market

Warren Buffett further wrote that the bond market is “not the place to be these days”: “Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at year end – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.”

Never Bet Against America

Most of Buffett’s letters over the years have included a doubling down on America and the nature of capitalism. This year’s letter was no exception: “In its brief 232 years of existence, however, there has been no incubator for unleashing human potential like America.”

As reported in this year’s letter, since its inception, the great Berkshire Hathaway has delivered a compounded annual return of 20% compared to the S&P 500’s 10.2%. Truly, the U.S. market will continue to be one of the strongest markets in the world.

Thanks for taking the time to review this newsletter. I hope you will have the chance to browse through Warren Buffett’s most recent annual letter yourself. It is a very enjoyable read.

To your success,

Andrew

PS: Spring is just around the corner and we are offering a 40% discount on our Elite Annual Memberships. Click here, or use discount code: LUCK40.

PS2: Please take a few moments and have a look at the book that Ardi and I recently wrote: A Beginner’s Guide to Investing and Trading in the Modern Stock Market.