How I Made $43K When Stock Market Crashed (MUST READ)

Market correction is finally here. But day trading is not investing; there are even more opportunities setting up for you now with more volatility.

Dear Traders,

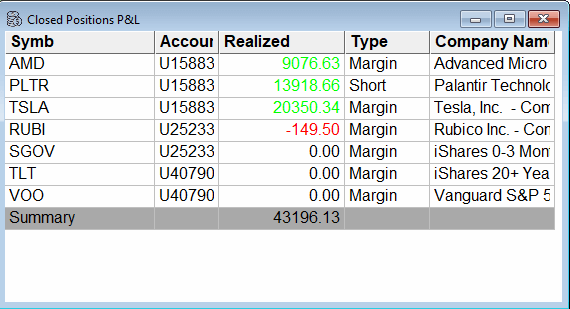

We finally have a “cool-down” on the major AI stocks including NVDA, PLTR and META, along with the premarket gap-down on SPY and QQQ. But interestingly, I took 2 good trades that were actually on the long-side, totaling $43K in my daily P&L.

When the news headlines are using words like “crash” “bubble” or “wiped off”, beginner traders would think that this is a day that they need to go all-in on shorting stocks and buying puts.

If you are part of Bear Bull Traders community, please don’t have that kind of mindset. In day trading, we want to trade what the price action tells us, not just our bias. I will explain with my own trade recaps below as well as how our BBT chatroom members traded today.

My best trade today was a long on TSLA. I only shorted one stock, which is PLTR. I also took a funny trade on RUBI, a halted small-cap stock, LIVE on YouTube, just to prove to viewers why small-cap trading is really not a sustainable approach if you want to trade for a living.

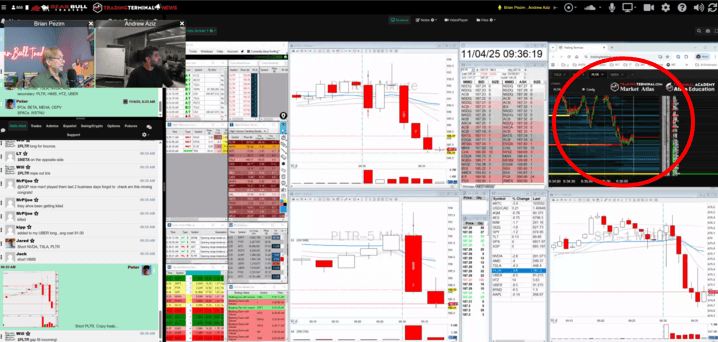

At the open, my main watch was PLTR, and I did plan to short it because the legendary Dr. Michael Burry (aka the man of the Big Short) revealed his massive short positions on PLTR and NVDA. This gave me the trade idea and bearish bias to short PLTR.

But I made a beginner mistake: I felt the FOMO, broke my rule and started shorting too quick because my bias was too strong. As you can see on the chart above, I had to exit the first trade because there’s sign of PLTR squeezing to a new high.

I regained control of my emotions, waited for the opening range breakdown to set up, and then entered again on my PLTR short. This trade turned out to be a decent short to a key liquidity level that I saw on Market Atlas. I took profits at the key level, and let my remaining runners stop out at break-even.

I traded live inside Bear Bull Traders chatroom with 800+ live traders, showing my full thought process and the key liquidity level on Market Atlas.

The best trade today for me was a VWAP reclaim breakout long on TSLA, also taken within the first trading hour. Initially, I went in long on a 1-minute ORB setup, but got stopped out according to my 1R stop loss (good disciplined trade). Then, I saw the VWAP reclaim, forming a clean reversal pattern for me to re-enter, scaling out all the way from $452 to $460 (a +4R trade).

So the lesson here from my trade recap today is: stick to your trade book, and let the price tell you when to enter, not your bias.

Today at 8 PM Eastern Time, Megan, our leading trader at Peak Capital Trading, will be hosting a Live Webinar Masterclass on “Why you’re getting stopped out before the move”.

This is a perfect learning session for traders to adapt to the market environment, as the sentiment has started to shift toward bearish and uncertainty.

Click here to sign up for Megan’s Masterclass Live at 8PM ET

I’m very proud of our BBT chatroom community today because we have traders who were profitable on the long-side, and also traders who caught the sell-off on the short-side.

Let me share some of the trades of BBT live trading members here.

An OG BBT member, Jessie took a reversal long on SOFI, executed with beautiful profit taking techniques!

BBT member Rogelio took a ORB Short on $NVDA according to the premarket watchlist, combining this strategy with Thor’s Camarilla pivots!

There are many ways to make a living in trading. If you still struggle in trading, or if you still don’t know where to start, you can start with our 3 Free BBT Trading Strategy Crash Courses.

You can learn these 3 trade books for free and then come to trade live with us:

- 1-min Opening Range Breakout by Andrew Aziz

- Camarilla Pivots Strategy by Thor

- 5-min Opening Range Breakout with Options by Megan

Learn 3 BBT Trade Books for FREE

See you in the chatroom tomorrow,

Andrew