Massive Earnings + Fed Meeting = Big Trading Moves

Dear Traders,

This week is shaping up to be one of the most important weeks in the markets for the next few weeks. Why? Because we have some major earnings and economic events lined up that could move the market big time up or down.

Let’s dive into it.

We’ve got some heavy hitters reporting earnings. These are the types of names that can shake the entire market:

Wednesday: Meta, Microsoft, and Robinhood

Thursday: Apple, Amazon, and Coinbase

These companies alone represent trillions of dollars in market cap. Their reports can fuel rallies or cause sharp drops in indices like QQQ and SPY. If you’re trading tech, growth, or even just watching the broader market, these earnings are must-watch.

It’s not just earnings, this week is also packed with economic catalysts:

Wednesday: FOMC Meeting (Federal Reserve decision)

Thursday: Jobless Claims and Core PCE Price Index

The Fed’s interest rate policy is still one of the most powerful forces driving market behavior. Rates are also a central point of political tension, with President Trump weighing in regularly on policy. So it’s critical to stay focused and prepare yourself for volatility.

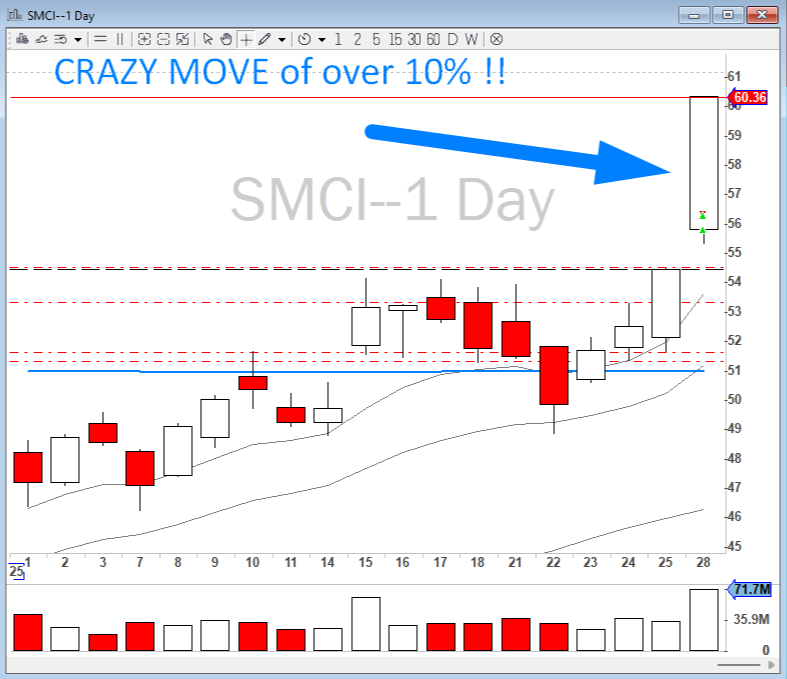

Today was an exciting day for me personally. I made some great trades on AMD and SMCI. SMCI ran over 10% and created amazing trading opportunities, especially for our community members who traded it closely.

Shoutout to Peter, Mike, John, Jared, and Brian. SMCI’s earnings are coming up on August 5th, and with continued bullish sentiment around AI, it might keep making moves.

How to Prepare for a Volatile Market

In times like these, your edge doesn’t come from luck. It comes from:

- Right Tools

- Right Strategy

- Sound Psychology

In our community, we focus on mastering all three. Here’s how you can plug in this week:

Monday – Strategy & Platform

12 p.m. ET – Trading with Bookmap with Nathan McConnell

Nathan breaks down how to read order flow using Bookmap and helps you spot real-time opportunities before they play out.

8 p.m. ET – New Member Onboarding with Carlos Moreta

If you’re new, this session is a perfect starting point. Carlos will walk you through everything, from platform basics to asking the right questions to start your trading journey.

Tuesday – Reading the Market

8 p.m. ET – Bookmap Deep Dive with Nathan McConnell

Nathan is back again to go deeper into spotting setups using liquidity zones and order flow data. Learn how to “see behind the candles” and anticipate price moves.

12 p.m. ET – Trading Platform Mastery with Brendon Dileo

Brendon will guide you through our trading simulators, DAS Trader and the Trading Terminal Simulator, so you can practice and test strategies in real-time environments.

Wednesday – Trading Psychology

8 p.m. ET – Mental Discipline with Michael Baehr

Michael will cover what real discipline means in trading, how to build it, and why it’s one of the key traits of consistent, long-term success. As a retired U.S. Marine Sergeant Major with 23 years of service across 3 wars, he knows discipline better than anyone, and he teaches it with heart.

Start Your Trial & Try Our Community for $19

AI and the Future of Trading

A lot of people ask me these days: What about AI? Will it replace traders?

Here’s what I truly believe:

Algo trading isn’t new. For over 50–60 years, Wall Street firms have hired brilliant mathematicians, quants, and the brightest minds to build trading systems that run on models.

AI is just the newest tool in their kit. But what makes AI powerful also makes it predictable; it’s still looking for patterns. And that’s where we, human traders, come in. We have intuition, adaptability, and decision-making that no AI can fully replicate, not at least until Artificial General Intelligence (AGI) is developed.

We’re not here to compete with AI, we’re here to use it. If you can recognize the footprints of algorithmic trading, you can ride those waves and make them work in your favor. AI will bring more volatility, more liquidity, and more interest in the markets. And that’s good news for us.

This week is big, really big. But the key is not to panic. The key is to prepare.

Stick to your process. Show up to the sessions. Learn something new.

Refine your edge.

Trading is not about chasing every move; it’s about building consistency, day after day, and learning from every trade.

We’ve built a strong community around these principles: Strategy, Technology, and Psychology.

Let’s grow together.

To your success,

Andrew