Trump vs. Powell: Volatility Returns to Wall Street

Dear Traders,

We had another amazing and volatile day in the stock market! I traded a beautiful 5-minute Opening Range Breakout on Tesla, and the recaps are coming soon. We also discussed the trade live on YouTube. The U.S. market continues to give us some wild volatility, and today, the drama came straight from Washington.

The main source of volatility today came from a growing tension between President Trump and the Chairman of the Federal Reserve, Jay Powell. Trump is accusing Powell of making interest rates a political issue. He says that during the Biden presidency, despite inflationary budgets, high energy prices, and heavy regulation that slowed economic growth, the Fed kept rates low, which led to major inflation.

Now, Trump argues, inflation is under control, energy prices are lower, regulation has eased, and the economy is set up for growth, yet Powell is keeping rates high, allegedly because he doesn’t support Trump’s trade policies.

Powell’s view? If it weren’t for the new trade tariffs, the Fed might have already lowered rates. But they want to wait and see how those tariffs impact inflation.

On the other hand, Treasury Secretary Scott Bessent says that most of the costs from tariffs are being absorbed through currency depreciation, and that producers in countries like China, Vietnam, and India who enjoyed significant profit margins, especially after the pandemic and those will be the ones who take the hit most. He believes this won’t significantly affect U.S. consumers and, even if it does, it would only be a one-time, small price bump, not true inflation.

In one interview, Bessent even joked that if Powell once believed inflation was “transitory,” this situation fits that definition better than anything: just a one-off adjustment.

But Powell disagrees.

Now, rumors are flying that Trump is lobbying for Powell to be removed and replaced a year early. The market didn’t take that well. Bonds sold off. The market dropped. Bitcoin and gold rallied as safe havens.

This back-and-forth is causing wild swings, which for skilled traders is a goldmine of opportunity. But for traders who don’t know what they’re doing, or are over-leveraged, it’s a bloodbath.

We are witnessing history here in the macroeconomy, and it’s important to not only pay attention but to benefit from these opportunities.

At Bear Bull Traders, we’ve got a lot of great material to help you stay sharp and informed. Especially on Wednesdays, we’re hosting some incredible webinars:

- 12 p.m. ET: Futures Mentorship with Vanessa. She’ll cover market structure and trading psychology for futures.

- 8 p.m. ET: Trade Like YOU Mean It. Vanessa will talk about building your own trading psychology, not copying others, but figuring out what works best for you.

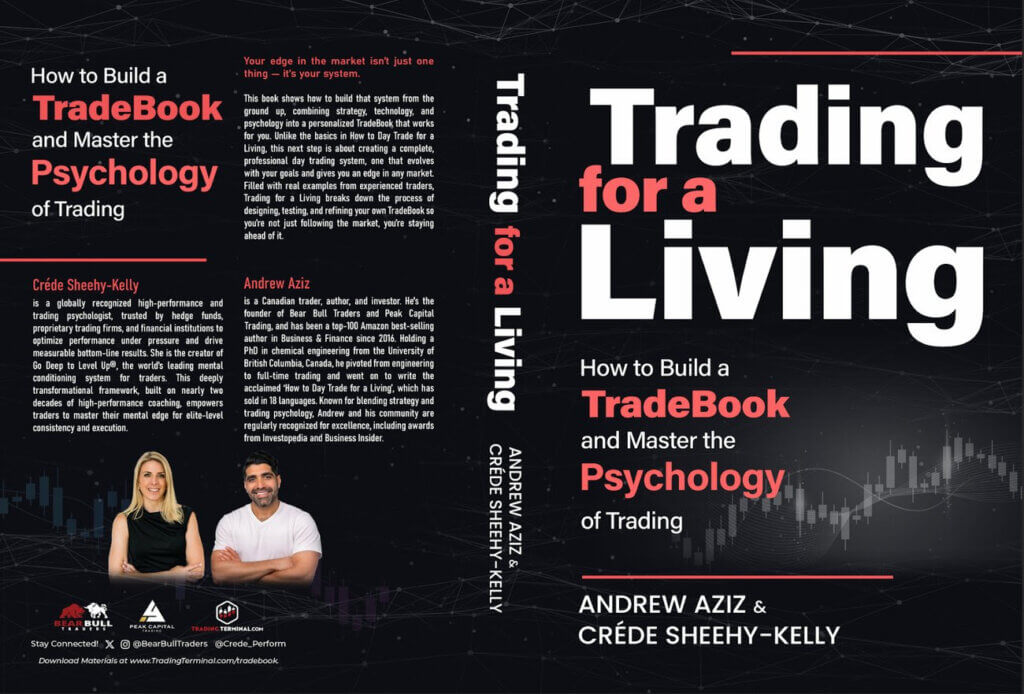

This topic is also the core of my upcoming book, which I’m co-writing with performance psychologist Créde Sheehy-Kelly. We’re aiming to publish it by the end of this week or early next week. Stay tuned!

If you’re serious about learning to trade and want to get the most out of this market, make sure to check out our Trading Terminal premium plan.

For only $59, you’ll get:

- All Premium Trading Terminal Academy Courses

- Real-Time Trading Simulator

- Market Replay Simulator

- Our custom-built real-time scanner (comparable to Trade Ideas, and yes, we’ve gotten a ton of positive feedback on it)

- Breaking News & Live Squawk (audio)

Coming soon, we’ll be adding:

- A journaling tool (currently used only by Peak Capital Traders)

- Depth of market and Level 2 visualization (like Bookmap)

- All of this is included in the bundle, and I promise to keep the price low and inclusive for everyone who trusts our community.

Join Trading Terminal Now

Let’s make the most of this market together.

To your success,

Andrew